Subtotal: $21.99

Today we’re talking about decentralized finance – what it is and how you can put your dusty old crypto to work generating powerful returns.

What Is DeFi?

Decentralized Finance, aka DeFi is taking all the products and services traditionally offered by banks and re-constructing them as smart contracts (software) on blockchains. When a smart contract is a full fledged application usable by consumers, we call it a dApp (decentralized application).

Just take a look at a bank’s website: Checkin/Savings Accounts, Borrowing, Lending, Investing and Trading are all being reconstructed as dApps on the blockchain.

For the same reasons we wanted decentralized money in the first place, we also want to put that money to work in a global, trustless and permissionless financial system.

Where To Start With DeFi

There are lots of companies offering to invest your money in DeFi on your behalf, we call them CeFi Banks or “Crypto Banks”. While it flies in the face of our ultimate goals, companies like Nexo, BlockFi and Crypto.com can act as a good stepping stone for familiarizing yourself with moving crypto around to earn yield.

Once you’re comfortable taking custody of your crypto, the first thing you should do is experience swapping tokens using a Dex. The largest Dex is Uniswap, but there are hundreds of Dex’s all with different rates and spreads. So consider using a Dex Aggregator like 1Inch or Matcha which will route your trade through the best Dex for the job.

Speaking of aggregators, Yearn is a “yield aggregator” that offers a super simple dApp for earning yield. Yearn is organized into Vaults. Yearn’s USDC Vault is a great place to start. Each asset has a different Vault and each Vault invests in a number of different strategies under the hood. But unlike CeFi, Yearn is all smart contract based so they never take custody of your crypto – smart contracts do!

Where DeFi Yields Come From

DeFi can seem extremely confusing. Just like Wall St. and traditional finance (TradFi), there are some very sophisticated “financial products” with very jargon-ey names. But for the most part, yield in DeFi comes from one of three places:

- Trading Fees – Decentralized Exchanges (Dex’s) charge a fee for swapping crypto which goes to the investors providing liquidity to the exchange.

- Borrowing/Lending – Just like a bank, you can loan out your money to earn yield. Also sometimes referred to as money markets.

- Incentives – This is where things get tricky. Many DeFi products created their own token and offer it as an incentive to use their platform.

Trading Fees

Uniswap charges 0.3% to swap one crypto for another. But that fee doesn’t go to Uniswap, it goes to Liquidity Providers (LP’s) who pool their assets to enable trading between two assets. SushiSwap, a fork of Uniswap, charges the same 0.3% fee except they split it 1/6 between Sushi token hodlers (0.05%) and LP’s (0.25%).

For example, an LP may create an ETH/USDC pool on Uniswap or more likely just contribute to a pool that already exists. They deposit, or “LP”, equal parts Ethereum and USCD to the pool which becomes the “liquidity” used for people on Uniswap to trade between these two assets.

If you contribute $100k to a $1m liquidity pool, you’ll earn 10% of all the swap fees generated by the pool. The larger the share of your pool, the more fees you collect and the more popular the pool the more fees will be generated!

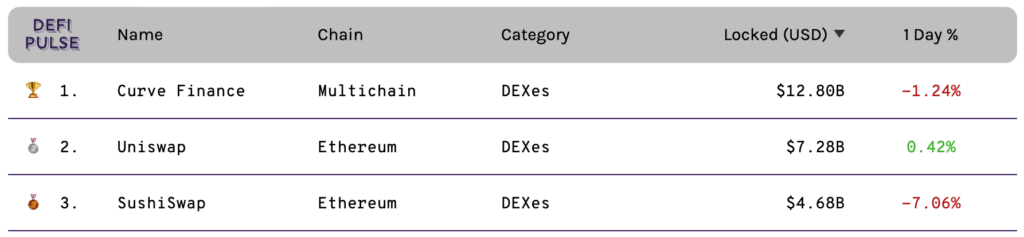

According to defipulse, there’s $31.43B LP’d in Dex’s right now (2021-09-05). ~$12.8B in Curve ~$7.28B in Uniswap and $4.68 in SushiSwap.

Borrowing/Lending

Bank’s bread and butter is lending out money. It’s often said that banks lend out the money you deposit in your checking/savings accounts, but really they just create new money from nothing. That’s how MakerDao (MKR) works.

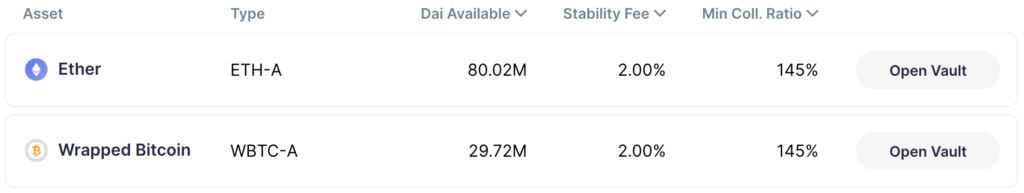

In Oasis, which is built on MakerDao, you can deposit collateral like ETH or wBTC and borrow money against that collateral for a fee, currently 2%. The money issued to you by MakerDao is DAI, their native stable coin. There’s currently $6.14B of DAI floating around in DeFi Land. And for example, $500M of all DAI is currently earning yield in Yearn’s DAI Vault! Now you can start to see how this all works together.

MakerDao earns the 2% fee which is used to buy and burn MKR tokens on the open market, but when borrowers and lenders are matched together we call it a Money Market. Popular DeFi money markets include Compound and Aave.

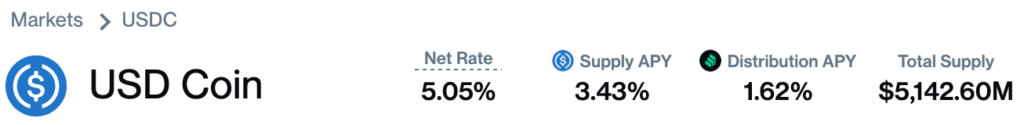

For example, below you can see some of the top markets on Compound. Currently you can borrow USDC at 4.67% or earn 3.43% for lending your USDC through Compound. Compound’s goal is to become a sort of “Prime Rate” within DeFi Land.

Incentives

The most controversial and largest source of yield in DeFi Land comes from incentives.

One way I like to explain incentives is like Airline Miles or PayPal back in it’s early days. Remember when PayPal offered you $5 to refer a friend and pay your friend $5 too? Well, that $5 was money give to them by their VC backers, and even when recorded in your PayPal account the $5 wasn’t realized until you withdrew it.

In DeFi Land, projects issue their own tokens and offer them as incentives. Even in the Compound example above, the 3.43% the protocol pays you is actually 5.05% after they include their “Distribution APY” which is paid to lenders as COMP tokens.

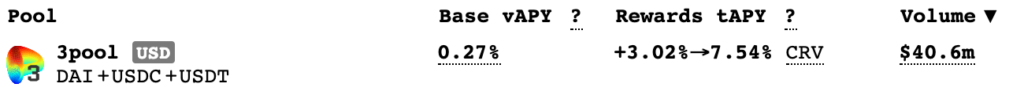

One of our favorite sources of yield comes from LPing into Curve, a DEX focused on stable coins and assets of similar value. Their 3pool currently earns a Base APY of 0.27% from swap fees and a Rewards APy of 3.02-7.54%. To earn maximum rewards, or maximum “boost”, you need to buy CRV tokens and lock them up for 4 years!

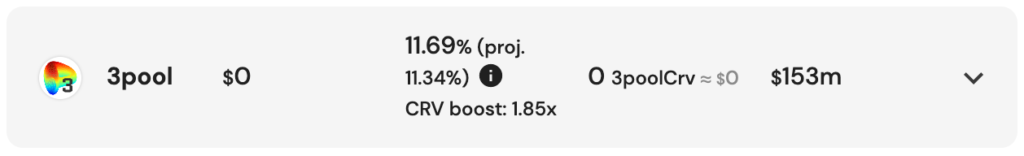

Curve’s lockup incentive system inspired Convex to build a CRV “pooling” structure on top of Curve. Instead of buying and locking up CRV you can deposit your 3pool LP tokens into Convex which pools your assets with other LP’s locking in the maximum boost. Not only do you get maximum boost for your Curve LP tokens in Convex but Convex issues it’s on CVX token as an incentive on top of it!

The way these DeFi protocols all work together is called “composability” or for fun “money legos”. You can see how these concepts can be quite powerful while remaining lucrative and controversial.

Hopefully now with some foundational understanding you can take the plunge and begin putting your crypto to work in DeFi Land.