⚠️ In May 2022, the Terra blockchain suffered an attack knocking UST off peg and causing the price of LUNA to collapse below a penny. This page is no longer maintained but is kept for historical reference only. More information on what happened can be found here.

In our previous guide to Anchor Earn we walked step-by-step through setting up a Terra wallet, converting Ethereum stable coins to wrapped UST (wUST), bridging wUST to Terra and dropping them in Anchor to earn 20%.

But saving is not the only thing Anchor can be used for. One way Anchor earns the yield it pays to savings account hodlers is through lending. Until recently, you could only borrow against LUNA within Anchor, but with Anchor’s recent partnership with Lido, now you can borrow against staked ETH (stETH) as well.

Too Good To Be True?

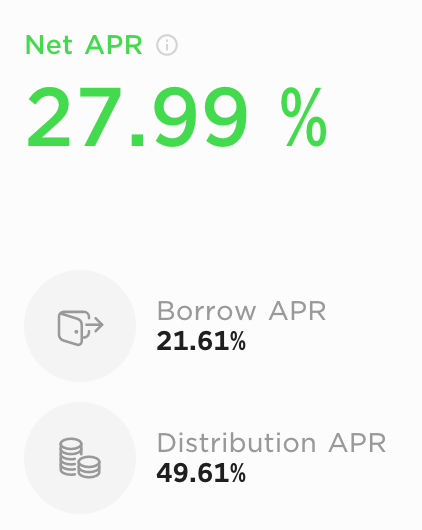

As Anchor is still in its early stages of adoption, they are heavily incentivizing borrowing to help bootstrap the network. At this moment (Aug. 13th 2021) you can earn 27.99% for borrowing. Usually it costs money to borrow! And that UST you borrow from Anchor? You can turn around and drop it into Anchor earning an additional 20%.

Again, this works because of Anchor’s ANC incentives. It currently costs 21.61% to borrow in Anchor, but the ANC rewards paid to borrowers are 49.61% resulting in a 27.99% profit. And thats before earning interest on the money borrowed. In the past, the net profit has been over 100%! But this is gradually going down as more and more people discover Anchor and as more collateral enters the system.

Example: Borrow UST Against LUNA

Let’s walk through a simple example of how this works:

- Buy 10 LUNA for $17 each and send them your Terra Wallet

- Bond all 10 LUNA in Anchor on Anchor’s Bond tab which converts it to bLUNA (bonded Luna)

- Provided the bLUNA as collateral at the bottom of Anchor’s Borrow tab

- Borrow up to $102 UST against your $170 worth of LUNA (because the max you can borrow is 60%)

- Deposit the $102 UST on Anchor’s Earn tab

- Claim your ANC rewards daily, weekly, or monthly on Anchor’s My Page tab

- Hodl your ANC tokens, stake them in the Govern tab or swap them in Terra Station for more LUNA and/or more UST to repeat the cycle

Tips When Borrowing On Anchor

Borrowing against your assets is an advanced strategy and should be used with caution. There’s a lot to know and understand so start small and increase your position as you become more and more comfortable with the system.

- Most places you buy LUNA from you’re actually buying wLUNA or “wrapped” LUNA which is LUNA riding on the Ethereum network. You need to bridge your LUNA to the Terra blockchain before depositing it as collateral in Anchor. More on this in our Earn guide.

- Pretty much every action you take will cost a small fee. So keep some spare UST or LUNA in your wallet for paying fees. $50 worth should be more than enough.

- When you bond your LUNA, you’ll receive slightly less bLUNA. For example bonding 10 LUNA results in 9.999928 bLUNA. The full amount will be restored when/if you convert (aka Burn) your bLUNA back to LUNA.

- If you decide to reverse all this and burn your bLUNA back to LUNA, there’s a 21 day hold. You can optionally “Instant Burn” for a small fee. For example, instant burning 9.999928 bLUNA results in 9.819214 LUNA (~2% fee)

- Don’t forget to provide your bLUNA as collateral at the bottom of the Borrow tab after you bond it. It’s an extra step that hung me up the first time I did this. The idea is that before providing bLUNA to Anchor the bLUNA is still in your wallet, after providing, it’s being hedl by Anchor’s smart contracts.

- The ANC rewards (aka Distribution APR) are the bulk of the reason we’re being paid to borrow, but the value of ANC has been trending downwards. Anchor is working on ways to improve this, but for now I claim my ANC and sell it for UST regularly, at least enough to ensure I have enough UST to pay back my loan + interest.

- Seconds after borrowing the UST will appear in your account. At that point you can switch to the Earn tab and deposit into the savings account.

⚠️ Avoiding Liquidations

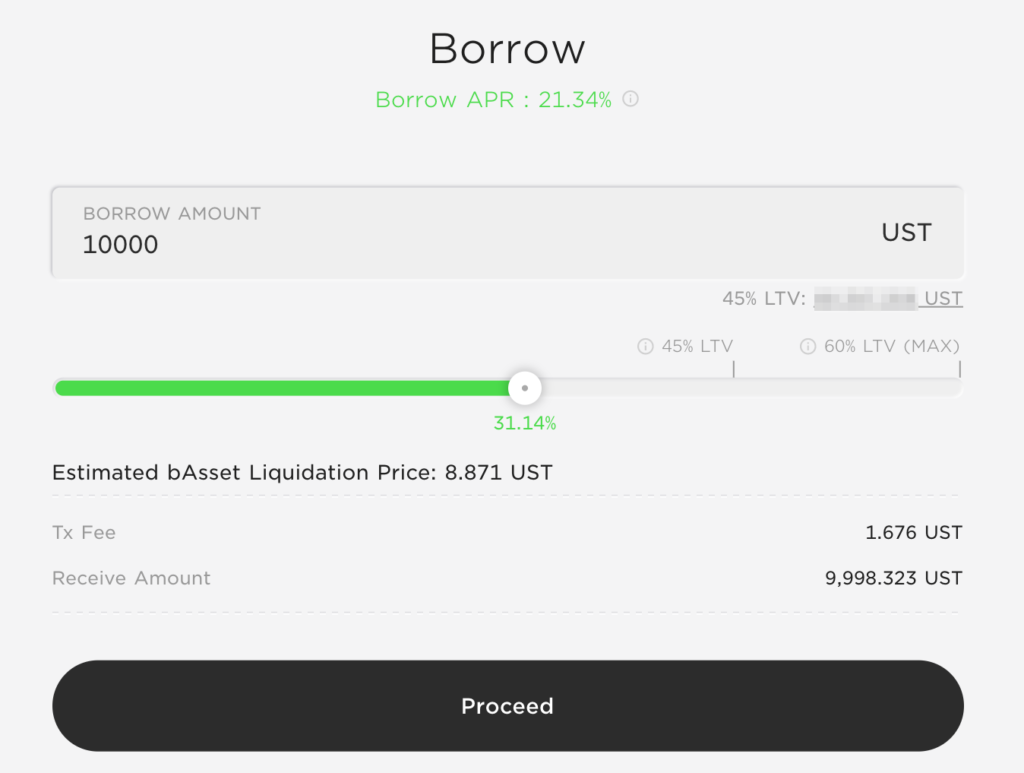

The amount you borrow divided by the amount of collateral you provide is known as your Loan To Value ratio or LTV. If your LTV goes over 60%, Anchor will automatically begin selling some of your bLUNA to bring your LTV back below 60%. This is referred to as liquidating your assets and it’s a worst case scenario!

Since Anchor liquidations begin at 60%, Anchor won’t even allow you to borrow more than 50%. The recommended LTV is 45%, but I prefer to stay around 30% to play it extra safe.

Anchor makes managing your LTV incredibly simple. As you punch in different borrow amounts you’ll see a green progress bar showing your LTV range as well as the exact price your collateralized asset would have to fall to for liquidations to begin.

When determining how much to borrow, I like to bring up the price chart of the asset to get a sense of it’s trading range. For example, when providing bLUNA as collateral I see on the chart that:

- LUNA is currently trading at $17.12

- Basic support lines show strong support around $12.50

- The 200 day simple moving average is at $10.40 and the 50 day is at $9.20

- So under $9 seems pretty safe and unlikely to happen in a flash (while we sleep for example)

I recommend setting a price alert using a mobile price tracking app to notify you if the price gets within 10-20% of your liquidation price. If the value of your asset starts dropping to uncomfortable levels you have two options:

- Pay down some of your loan! This is the easiest option and it’s the reason I recommend depositing the UST you borrow in Anchor Earn as oppose to investing it elsewhere. Keeping the UST in Earn keeps it liquid and keeps it just a few clicks away from paying down your loan should you need to do so.

- Deposit more collateral! For example, buy more LUNA and bond/provide it to Anchor.

But the even better scenario is that the price of your asset goes up and you can safely borrow more!

Calculating Your Return

If we go back to our example, after exactly one year a lot has happened:

| +0 | Your 10 LUNA which you bought for $17 each was worth $170. If the price of LUNA went up, that return is all yours. But for simplicity’s sake let’s pretend the price of LUNA stayed exactly the same. |

| +20.4 | You deposited the $102 UST you borrowed into Anchor which grew by 20%. |

| +50.6 | The $102 UST you borrowed earned 49.61% in ANC rewards for borrowing. |

| +4.03 | Every month you claimed those ANC rewards, sold them for UST and dropped them in Anchor Earn! That math is a bit tricker because it’s compounding but it works out to an additional 5.74% |

| -18.37 | It costs you 21.61% to borrow the UST. |

| =56.66 | Total return |

So if you bought this $170 worth of LUNA for the sole purpose of borrowing against it to implement this strategy, your total ROI would be 56.66 / 170 = 33.32%

Not bad for an asset which would have been collecting dust otherwise.