Boom1 marked the rise of Bitcoin in 2013. Boom2 in 2017 was centered around Ethereum and ICO mania. Boom3 brought us Ethereum Alternatives, DeFi and NFTs. As we wander the depths of the 2023 bear market, we’re revisiting each crypto sector to see how it performed during Boom3 and formulating our plan of attack ahead the next bull market – Boom4.

- #49 Boom4 Predictions – Part 1: Bitcoin

- #50 Boom4 Predictions – Part 2: Ethereum

- #51 Boom4 Predictions – Part 3: ETH Killers & L2s

- #52 Boom4 Predictions – Part 4: DeFi, Web3, DAOs & NFTs

In Episode #49 Boom4 Predictions – Part 1: Bitcoin, Gerbz and his bro (CMGerbz) took a deep dive into Bitcoin’s history through each of the three “booms” the crypto market has experienced to date. And while both Gerbz and his bro like to stack BTC, the crypto they find themselves using is ETH.

Gerbz’ portfolio currently consists of 20% ETH, and while he still uses BTC in his business, he is focusing on increasing his ETH stack going into the next cycle – Boom4.

ETH is growing faster than Bitcoin – and this makes sense as ETH is a platform for building decentralized applications on top of.

Ethereum’s Innovative History

The Ethereum network has already innovated in a number of ways, including EIP-1559 and the transition from Proof of Work to Proof of Stake.

Ethereum launched as the first ICO of all time in 2015 but wasn’t traded on Coinbase until May of 2016. It was the first crypto Coinbase launched after being Bitcoin only for many years. The 2017 boom (Boom2) was largely driven by ICOs built on ETH.

During Boom2, people new to crypto mistakenly thought there were thousands of blockchains, when in reality most of these crypto assets were built on Ethereum.

Boom2 was really built on business plans and ideas – not functioning products. In contrast, the last cycle (Boom3) was all about the products being built on Ethereum. A lot has changed in a very short time.

We’re now seeing Ethereum blossom into a true foundational layer with lots of new ideas, products, and innovation that allows people to build things on top of it. In a way, it’s similar to how the Internet evo in its early days.

Proof of Work to Proof of Stake

In the Bitcoin episode we discussed how Bitcoin is hesitant to change. Ethereum is much different – innovation is happening at the base layer. Perhaps the biggest change was the merge from Proof of Work to Proof of Stake. This is a big deal as far as energy consumption goes, the overall speed of transactions, and now the possibility of scale. Proof of Stake is a first step, a base layer requirement to now built L2s and scalability improvements on top of – things that simply weren’t possible with Proof of Work.

This was a huge deal for Ethereum, a technological feat, like swapping out the engine of an airplane while it’s in mid-flight. A lot of people were very concerned something bad would happen, and there was a lot of anxiety surrounding The Merge. But the plan didn’t crash, and everything went to plan.

EIP-1559

The next “big” thing to happen with Ethereum was EIP-1559, which dramatically changed the supply and issuance of Ethereum.

One of the things that has always been in question with Ethereum is its issuance mechanism. Unlike Bitcoin’s strict issuance schedule and hard 21M cap, Ethereum’s inflation rate has always been a bit “flaky.” EIP-1559 looked at the inflation rate of Ethereum as well as the demand and usage of ETH that affects this rate.

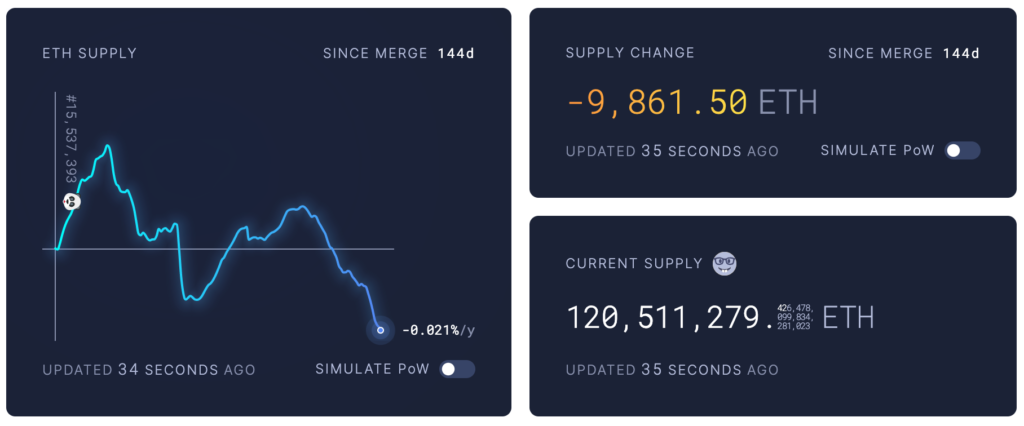

In Bitcoin, transaction fees go to miners, but now with EIP-1559, the base fees added to every transaction on Ethereum are burned. Only Priority Fees going to Ethereum validators. What makes this interesting is that now more ETH is being burned than issued. There’s 120M ETH in supply right now, and since the merge to Proof of Stake Ethereum has been deflationary.

The burn will continue, and this economic schedule was designed so that about every year, 1M more ETH are going to get burned (this goes on for the next ~50 years). Currently, they’re projecting that ~200 years from now, the supply of ETH should stabilize around 50M.

Although we cannot even fathom what will happen 200 years in the future (let alone tomorrow, in cryptocurrency!) these long term plans show that Ethereum is committed to being a huge global economic player down the road.

The Future of Ethereum’s Base Layer

As exciting as these ambitious plans are, it’s also scary because the transition to using Layer 2’s built on top of Ethereum means no longer interfacing directly with the base layer. This transition to L2s is a little bearish in the short term, because it means less transactions and less fees for the base layer. But if you’re thinking long term, Ethereum is setting itself up to be the foundational layer for a global internet and digital money – which is super bullish.

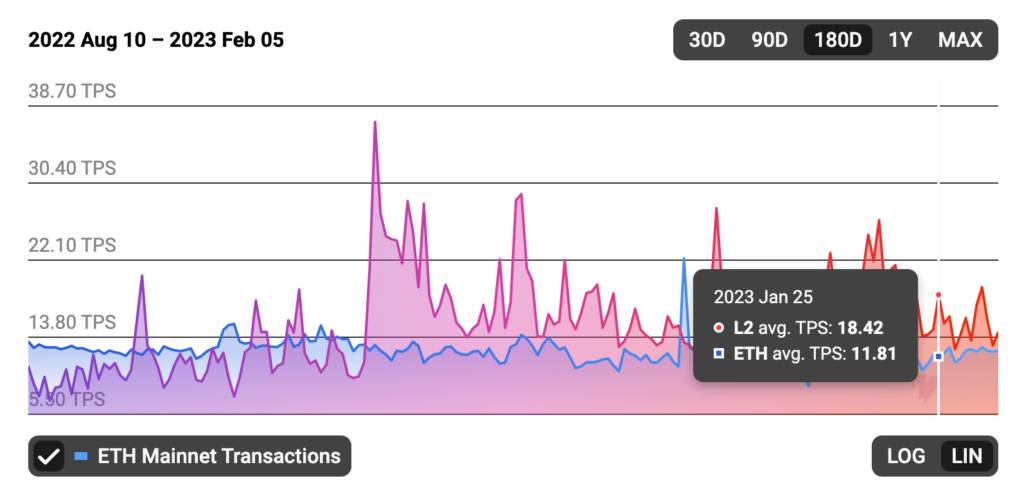

L2s act like layer on top of the blockchain that wraps up thousands of transactions into one cryptographic proof that only requires a single transaction on the base layer to verify all of them. The long term idea is that there’s going to be enough layer twos doing so many transactions that this alone will fill up the blocks and continue the deflationary burn that Ethereum is going through.

This is a big vision, but it’s happening right now before our eyes. Around Oct 2022 the number of transactions on L2s outpaced the number on the base layer – the L2s combined did more transactions per day than Ethereum did at its base layer per day. We’ve already flipped, and that’s almost unreal because hardly anyone is even using L2s yet.

It’s a little scary to think that most of us won’t be interfacing wit the base layer in the future, but it sounds like that’s where we’re heading.

Staking Changed the Game

Whereas you basically need to be a miner to earn yield in Bitcoin land, Ethereum allows you to generate income from the base layer. On the Proof of Stake network, it currently does about 3-8% rate of return. This is what we refer to as the “risk-free rate” and should create a lot of demand – people will be buying ETH just to stake it and generate income.

In Episode #46 Staking Your ETH – Part 1: Base Layer Yield In Proof of Stake, Pete predicted that 80% of all ETH will get staked. If that happens, only 20% of ETH will be in circulation – which will create explosive price movements as demand for ETH increases.

It also may cause price volatility similar to the 2017 ICO boom where ETH crashed to around the ~$100 to $300 range for a long time (Dec 2018 through COVID). Then the Bitcoin halving kicked off Boom4 where ETH topped out around ~4.8k.

That’s nearly a 5,000% gain – this is unheard of in most investing (when was the last time Microsoft stock had a 5,000% gain?). Gerbz recommends keeping portfolios that prioritize the “blue chip” cryptocurrencies. Volatility is unlikely to stop soon, and the best strategy is always to dollar cost average over an extended period of time.

If you don’t have cash to dollar cost average into more crypto, you should consider snowball farming, which uses yield from staking to grow your crypto holdings.

What’s Next for ETH?

Currently ETH is hovering around the ~$1,550 range. In the 2017 cycle, we fell 90-95% from the high to the low. This time around, the “crash” (peak to trough) is roughly ~80%. It would appear the bottom is in, and if this is the case it’s a very bullish sign.

We could definitely still have a bad week, or drop below $1,000 – but it appears that with each cycle ETH will drop a little less. It’s definitely trending in the right direction.

The large majority of newcomers enter crypto during a bull market and buy at the top (or close to it). Some may experience that euphoric moment – others will be humbled when the price crashes. A small percentage of those folks will go down the crypto rabbit hole, and understand that the future of money will be built on these blockchains. These are the people that stick around during the bear market, when the general public has forgotten about crypto and has moved onto more “sensational” stories like the FTX collapse.

Zoom out, and see through the market through the lens of cycles. If the goal is to buy low and sell high, the ideal time to buy is during a bear market – like the one we have now. People that disappear and only come back for every “boom” when the excitement is back are not investors – they’re gamblers.

ETH’s $1T Market Cap

In Episode #49 Boom4 Predictions – Part 1: Bitcoin, Gerbz broke down how the $1T market cap for Bitcoin would require a price of $52k/BTC. For Ethereum to achieve the same $1T market cap (based on its current supply of ~120M) the price of one ETH would need to be $8,300.

Gerbz points out that ETH always seems to be one cycle behind BTC. ETH’s ICO boom happened after BTC’s previous boom where Bitcoin foundationally stabilized. And now Ethereum is foundationally stabilizing – always one cycle behind. The $1T seems very likely and Gerbz recommends keeping an eye on the $8,000 price level.

ETH maxis will sometimes talk about ETH being a $10T asset, but that would be $83k, maybe a few cycles down the road when crypto truly is money and governments have stopped printing paper currency.

ETH Demand Drivers

As for what is being built on ETH, the most obvious is DeFi. As far as controlling your own money, using smart contracts, and using code to govern what you do with your money – DeFi is undoubtedly the way forward. Every time a centralized crypto scandal (like FTX) occurs, it just validates why decentralized finance is so important in this space.

The next biggest ETH product is Web3. The original vision for Ethereum is that it’s the world’s super computer and the new Internet is going to be built on top of it. Currently, we are seeing infrastructure being built like decentralized domain names on ENS and decentralized file storage using Filecoin. Currently, the dApps are still accessed via Web2, but as the infrastructure improves, DeFi platforms will move towards Web3, further solidifying Ethereum as a foundational layer.

Lastly, NFTs – the most misunderstood piece of the cryptosphere. NFTs are about the rise of the Creator Economy. Everyone working for themselves on the decentralized internet. Creations today are digital first – so the only way to create authentic versions of these products is to mint them as NFTs. In the future, every time any piece of art, music, or other content is interfaced with – it’s going to happen on the Ethereum blockchain.

NFTs also present a way for creators and their fans to have direct relationships – something that has been chiseled away at over the years through 3rd party publishers (who also take the majority of artists’ revenue). People want to support the creators they love, not a media conglomerate – and NFTs are a way of making that a reality.

To sum it all up, the investment opportunity in both Ethereum and the projects being built on Etherum are as vibrant as ever. It’s a great time to go down the ETH rabbit hole.